Zero to One: 7 questions every business must answer

An entrepreneur can’t benefit from macro-scale insight unless his own plans begin at the micro-scale.

We are getting close to completing Peter Thiel’s book,, Zero to One. As a reminder, our suggested reading schedule, can be found in this first post about the book. So, if you’re falling behind, this is the time to dive in a catch up. It’s not a very long book and it's full of more insights than you’ll get in a university classroom — unless you were one of the few who have been able to get that education from a class Peter has taught at Stanford.

On Thursday, October 24 at 1:00 PM ET, we’ll be joined in a live Zoom session by someone who helped Peter teach that class for a few years — Michael Gibson, the former VP for Grants for the Thiel Foundation. Mark your calendar now register here.

Today’s review covers Chapter 12 and 13.

***

What Peter does in both of these chapters is takes the philosophy he has been writing about in the first part of the book and applying it to AI / technology (chapter 12) and green energy (chapter 13). You can see how his philosophy relates to how he considers investments in these very trendy fields.

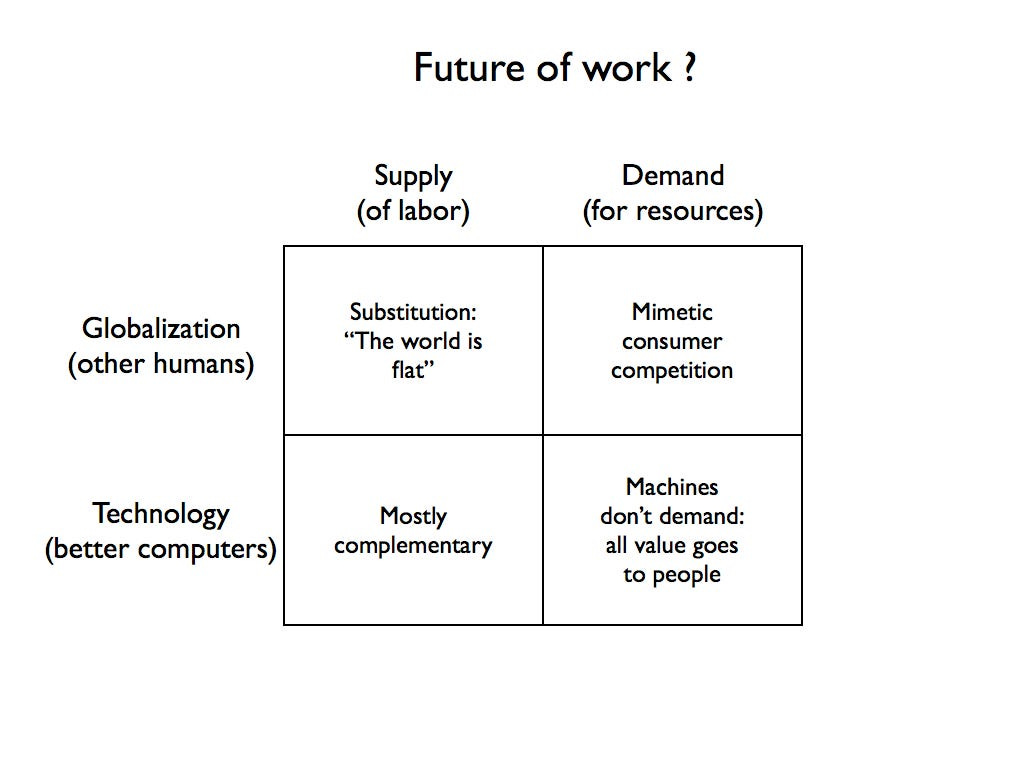

In Chapter 12, Peter compares Americans’ fears of losing jobs to globalization vs losing jobs to Artificial Intelligence (AI).

He sees these as different in a fundamental way. In globalization, people are competing with each other for both jobs and resources. With AI, computers compete for neither.

He believes men and machine are good at fundamentally different things. According to Thiel, gains from working with computers should be much higher than gains from trade with other people.

Thiel believes that technology is one way for us to escape competition in a globalizing world. And remember: one of the fundamental beliefs he articulated earlier in the book is that all great companies are monopolies. They do something no one else is doing and have escaped the competition.

As computers become more powerful, they won’t be substitutes for humans, they’ll be complements. This isn’t just a macro-scale fact. It’s also the path to building a great business.

And that path, for Peter, means finding a way to have a man-machine symbiosis, which is what helped PayPal retain profits as it used both man and machine to find the $10 million of credit card fraud it was losing each month to scammers. It’s also how another company he co-founded, Palantir, worked to help the government to use both the power of man and machine to extract insight from divergent sources of information.

Bottom line: better technology won’t replace us. It will empower us to do even more. The question we should be asking: how can computers help humans solve hard problems? Many of the great companies in the near future will answer that question to solve a problem for others and have a very successful business.

***

One trending area of the economy at the very start of the 21st century revolved around green energy. And that’s the subject of Chapter 13.

Peter believes that this is an important area to develop because, with the rise of prosperity around the world, more and more energy is going to be used. We need to find new, more affordable, and cleaner forms of energy.

The problem that occurred in the first decade or so of this century is that the more than $50 billion of investment into this sector to cleanse the world through clean energy did not work. Instead, we got a massive cleantech bubble.

Peter says that most cleantech companies crashed because they neglected one or more of the seven questions that every business must answer:

The Engineering Question: can you create breakthrough technology instead of incremental improvements?

The Timing Question: Is now the right time to start your particular business?

The Monopoly Question: Are you starting with a big share of a small market?

The People Question: Do you have the right team?

The Distribution Question: Do you have a way to deliver your product?

The Durability Question: Will your market position be defensible in 10-20 years?

The Secret Question: Have you identified a unique opportunity that others don’t see?

Look back at these questions for any business you have started or plan to start in the future. How do you answer these questions? What might you do with your business that can help you achieve the right answers to these questions?

Every great business plan must address all of these questions. If you don’t have good answers to them, your business will fail. If you nail all seven, you’ll have master fortune and succeed. If you can get five or six correct, your business might work.

The cleantech bubble reveals that people were starting companies with zero good answers.

Engineering — they were not creating products that were 10x better, only maybe 2x better, at best. This meant almost no improvement at all for the end user.

The time was not right for exponential growth.

No cleantech executive believed their company had an edge, only that the market was big enough for them all. This led to the exaggeration of the monopoly question. And when you start exaggerating, you don’t really own a big share of any market.

Their teams were shockingly nontechnical. Most had founders that were dressed in suits to deliver their pitches to potential investors. Peter says that “real technologists wear T-shirts and jeans.” After all, the best sales is hidden.

Cleantech courted governments and investors, but forgot about customers.

Cleanteach embraced misguided assumptions about the energy market as a whole. As one example: they didn’t see fracking coming and that became a major problem that cleantech had to compete with.

Each of the casualties of the cleantech bubble described their futures using broad conventions on which everybody agreed. But, according to Peter, great companies have secrets: specific reasons for success that other people don’t see.

***

Then Peter goes through the success formula of Tesla. Why did Elon Musk do so well with Tesla compared to others in the cleantech space? Tesla was able to get the seven questions right.

Their technology is so good that other companies rely on it.

Timing: while other cleantech companies thought subsidies from the government would constantly flow, Musk saw it as a one-time opportunity.

Tesla dominated a small market first: high-end electric sports cars. This gave them opportunity to do the necessary R&D and expand and dominate other markets.

Tesla’s CEO is the consummate engineer and salesman.

Tesla decided to own the entire distribution chain for its product.

Tesla’s head start and movement ahead faster than anyone else means its lead is set to widen in the years ahead.

It’s secret? Tesla knew that fashion drove interest in cleantech. Many people want to own clean energy cars to “feel” or “be” cool, in a virtue signal kind of way. Tesla decided to build that car made drivers look cool, period — whether they cared about driving a green car or not.

I’m not a huge fan of the Tesla cyber truck, but when a friend rented one for a week, I had the sudden urge to check it out and then ask him to take a photo of me in it. I did that two months before reading these pages from Zero to One. What Peter Thiel identifies here is 100% right. I don't even like this truck. But a photo? I wanted to look cool.

***

The takeaway from Chapter 13 is that an entrepreneur can’t benefit from macro-scale insight unless his own plans begin at the micro-scale. A valuable business must start by finding a niche and dominating a small market. Paradoxically, the challenge for the entrepreneurs who will create Energy 2.0 is to think small.

***

For the week ahead, we only have a little bit left here to finish. By next Friday, October 18, read chapter 14 and the conclusion. That’s it.

***

Looking ahed to November and December: we’ll be reviewing the book, The Illusion of Time by Francois de Neuville, a Belgian author who I got to know last year and recently became a Featured Innovator in the Fearless Journeys community. He has some wild stories, including being a survivor of the tsunami in Indonesia. We’re going to learn from his perspective about the illusion of time and how to make the most of ours today. You won’t want to miss this book and your opportunity to directly connect with Francois. Order it to day to be ready to read it together in November.